In the Philippines, purchasing a vehicle, either a car or motorcycle, can be expensive. However, there are ways on how you can finance your purchase without saving up for a long time. One of the commonly known terms is the Chattel Mortgage.

In this comprehensive guide, we will explain what a chattel mortgage is, how it works, the benefits it provides, and why you should consider asking for assistance with a service provider like FileDocsPhil to assist you in the process.

What is Chattel Mortgage in Auto Loans?

A chattel mortgage is a type of loan agreement in which a movable asset is used as collateral to secure the loan. Unlike a regular mortgage that applies to real estate properties, chattel mortgages are used for movable properties, including vehicles, equipment, and machinery.

In auto loans, the finance or lending institution (bank or financing company) retains ownership of the vehicle until the borrower fully repays the loan. The buyer, however, has possession and use of the vehicle during the loan period. Once the loan is settled, the ownership is transferred to the borrower, and the chattel mortgage is canceled.

Certificate of Registration Encumbered (CRE)

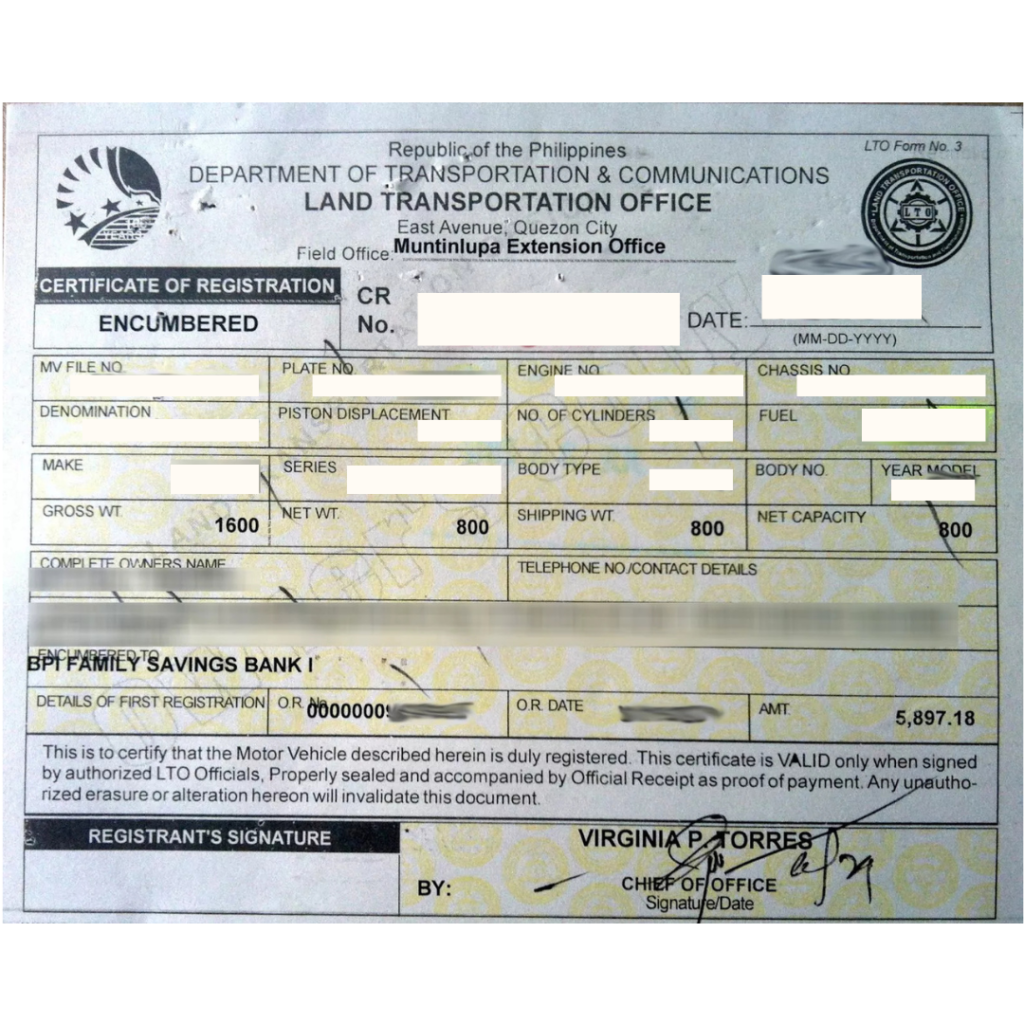

When a vehicle is bought through an auto loan with a chattel mortgage, the Land Transportation Office (LTO) issues a Certificate of Registration Encumbered (CRE) instead of the regular Certificate of Registration (COR). This indicates that the vehicle is under the ownership of the lender which prevents unauthorized sales or transfers until the loan is fully paid.

Once the loan has been fully paid, the borrower can now process the release of chattel mortgage. After the cancellation of the chattel mortgage, the borrower can apply and update their CRE to a regular COR at the LTO.

Certificate of Registration Encumbered (CRE)

How Chattel Mortgage Works in Auto Loans?

If you want to purchase a car or motorcycle, this is the common process for how you can apply for a motor vehicle or car loan with Chattel Mortgage.

Step 1: Auto Loan Application

You need to apply for a loan from a bank or lending institution, specifying that it will be used to purchase a vehicle. The lender will assess the application by conducting due diligence regarding the applicant’s credibility, employment status, and financial capability.

Once approved, the lender provides the loan terms, including the downpayment (if any), interest rate or amortization, and monthly payment.

Step 2: Chattel Mortgage Agreement

The lender will implement a chattel mortgage agreement that the borrower should sign, making sure that he/she agrees to the terms and conditions. This will be registered with the Registry of Deeds, establishing legal ownership of the lender over the asset (vehicle) as collateral.

Step 3: Payment of Fees

There are fees that the borrower needs to pay when dealing with chattel mortgages. This covers the registration and processing which may include documentary stamp and notarial fees.

Step 4: Vehicle Ownership and Use

While the borrower can use the vehicle freely, the lender maintains the ownership or legal title of the asset until the loan is fully paid. Default or failure to pay the loan may result in repossession of the vehicle.

Step 5: Cancellation of Chattel Mortgage

Upon full payment, the lender will release a chattel mortgage. The borrower must process the cancellation of the mortgage and wait for the release of the Cancellation Certificate from the Registry of Deeds then, proceed to the designated LTO branch to have it removed from the vehicle’s CRE and issue you a new CR without “Encumbered” annotation.

Why is Chattel Mortgage Important?

Chattel mortgage offers benefits for both lender and borrower. This protects the lender against default, as the vehicle serves as collateral.

For borrowers, chattel mortgage offers flexible loan terms, allowing borrowers to select repayment schedules that fit their financial capacity. They also provide access to higher loan amounts, as the lender has an assurance of repayment. Furthermore, successfully repaying a chattel mortgage improves the borrower’s credit standing, making future loan applications easier. Most importantly, once the loan is fully paid, the ownership of the vehicle is officially transferred to the borrower, granting full control over the asset.

Sound’s Overwhelming? It doesn’t have to be!

Processing a chattel mortgage can be overwhelming due to the numerous steps involved. A professional service provider like FileDocsPhil can help simplify the process, ensuring everything is done accurately and efficiently.

We assist with document preparation, including chattel mortgage agreements, affidavits, and notarization. Our team also handles the registration and cancellation of chattel mortgages at the Registry of Deeds and filing in LTO, saving you time and effort.

Additionally, we stay updated with legal requirements, ensuring compliance with Philippine laws and regulations. With our expertise, you can avoid errors and delays, making the entire process seamless and hassle-free.

Let FileDocsPhil Do the Work!

Need further information and assistance in Title Transfer through Self-Adjudication?